Private and international schooling can be a highly attractive business and often appeals to private equity investors. Education can be a very ‘sticky relationship’ between the parent and the school – a single enrolment of a child can mean a commercial relationship between the parent and the school for 10 years or more.

But schools operate in competitive environments. Private schools, mainly populated by local children, rely a lot on their catchment areas (the wealthy local population). International schools are also becoming attractive to local populations, but they still depend on expatriates as their main source – none more so than Singapore, where local children are usually not permitted to attend international schools. Inbound expat parents have little or no attachment to the neighbourhoods in their host countries, and might choose schools before their homes, gearing their choices around the best school, rather than the best location to live.

International schools face increasing competition. More schools are opening, existing schools have taken on more capacity through extensions and larger campuses, yet expat numbers are falling in some areas.

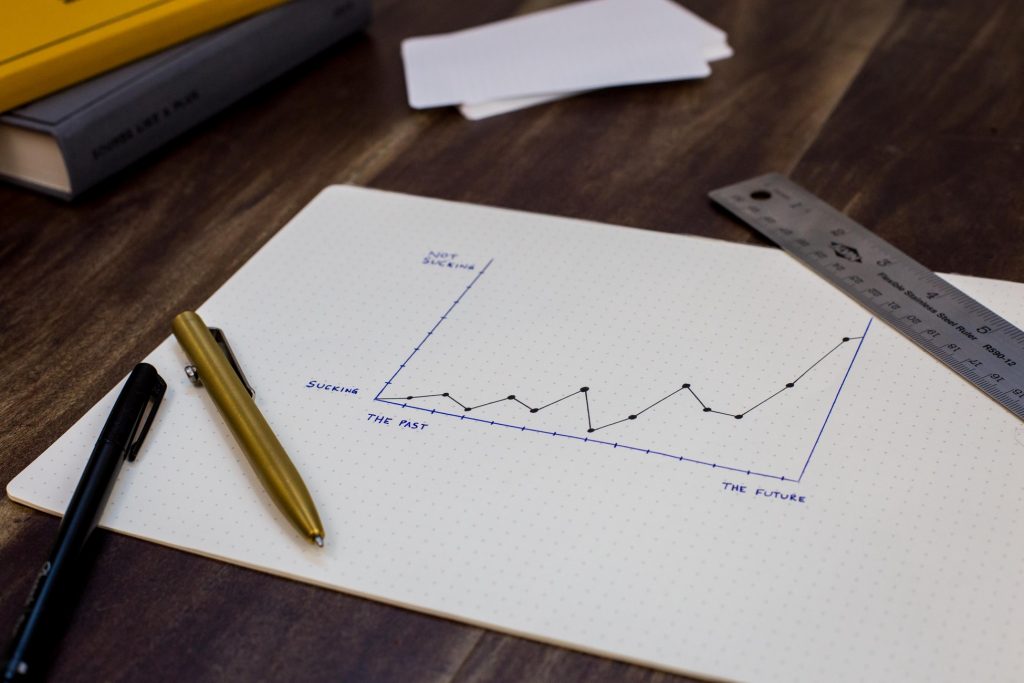

Schooling is a complex purchase path with many pitfalls along the journey. We help schools to tap into this purchase pathway to maximise the conversion of inquiries to enrolments.

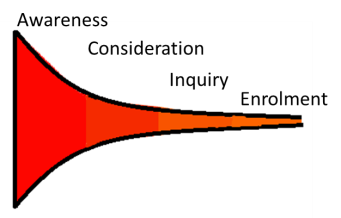

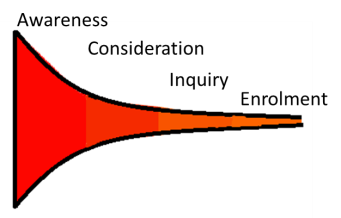

Stage 1 is raising awareness of the school among parents. This relies a lot on word-of-mouth, but marketing and advertising play an important role.

Stage 2 is getting your school into the consideration set of the parent. This again depends on word-of-mouth, but the messages that schools send out through corporate communications and social media is also highly important.

Stage 3 is prompting the parent to inquire, e.g. a call to action

Stage 4 is the school visit – the opportunity for the school to ‘close the sale’

Stage 5 is closing the sale, which, over a 10 year engagement, could be a $300,000 sale, not to mention potential sibling enrolment in the same school later on.

Based on our international schools brand equity research, the average ratio of likelihood to consider a school compared to overall awareness of schools is 24%. The ratio of inquiry to consideration is 68%. But the conversion of inquiry to enrolment is considerably less as parents will typically evaluate three to four different schools for their final selection.

How do parents make choices about international schools?

Considerable research has gone into understanding consumer behaviour towards purchase decisions. For many consumer goods categories, consumers rely on their fast, instinctive, impulsive thinking to make decisions which we refer to in behavioural economics as the ‘System 1’ brain. But deciding on which international school to send one’s offspring is one of those more complex decisions that involves more of the logical, considered, thinking employing rational trade-offs. In short the ‘System 2’ brain.

You might, then, be surprised to find out that System 1 still plays an important role in decisions on international schooling. When faced with complex decisions, consumers still use mental short cuts to help them find reasons to eliminate a school from their consideration set. Sometimes these things are very small details that they notice during their inquiries with the school, and more significantly during the school tour itself. These can range from lack of response to the parent’s initial email inquiry, the admissions department sending out the wrong signals over the phone (e.g. inappropriate tone), or the wrong impressions given on the school tour.

International schools are investing a lot in building their brand equity and image, but sometimes overlook the elements of the purchase path that can help land the $300,000 sale.

Our mystery audits of international schools have highlighted ways to significantly enhance inquiry handling and the management of the school tour that will lead to higher conversion rates to enrolment. Often these are small details that schools can implement easily without significant cost. Do get in touch if you would like to know more about our services in this area.

Click here to read this article on BVA BDRC Asia

![[Podcast] Sbfm25 – School Marketing And Social Media Survey 2019](https://www.schoolhouse.agency/wp-content/uploads/2021/08/PODCAST-SBfm25-–-School-Marketing-and-Social-Media-Survey-2019.png)